In today’s dynamic financial landscape, stock trading remains a pivotal avenue for investors seeking to grow their wealth. Whether you’re a seasoned investor or a newcomer to the markets, understanding the fundamentals of stock trading is crucial for making informed decisions and achieving financial goals.

Introduction to Stock Trading

Stock trading is the buying and selling of shares in publicly traded companies. It enables investors to participate in the ownership of these companies, with the potential to profit from price movements in the stock market. From the bustling floors of major stock exchanges to the convenience of online trading platforms, the mechanisms of stock trading have evolved significantly over the years.

Types of Stock Trading Strategies

- Day Trading: Day traders execute trades within the same trading day, aiming to capitalize on short-term price fluctuations. This strategy requires quick decision-making and a deep understanding of technical analysis.

- Swing Trading: Unlike day trading, swing traders hold positions for several days to weeks, leveraging both technical and fundamental analysis to identify trends and profit from price swings.

- Long-Term Investing: Long-term investors focus on the fundamentals of companies, aiming to hold stocks for years or even decades. This strategy emphasizes research into company financials, management quality, and industry trends.

- Momentum Trading: Momentum traders seek to capitalize on trends that have significant price momentum, often using technical indicators to identify opportunities for quick gains.

Basics of the Stock Market

Understanding how the stock market operates is essential for any aspiring trader. Major stock exchanges such as the New York Stock Exchange (NYSE) and NASDAQ serve as platforms where buyers and sellers meet to trade stocks. Each stock exchange has its listing requirements and trading hours, influencing how stocks are bought and sold.

Getting Started with Stock Trading

- Choosing a Brokerage Account: Selecting the right brokerage account is crucial, as it provides access to trading platforms, research tools, and customer support. Consider factors like fees, customer service quality, and available investment options.

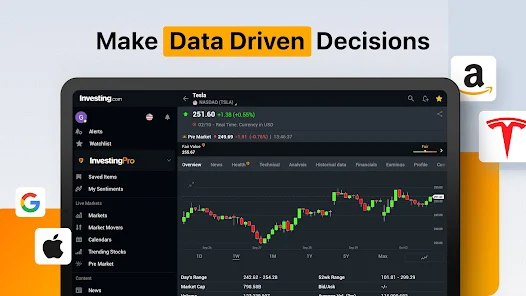

- Understanding Trading Platforms and Tools: Modern trading platforms offer a range of tools and features to assist traders. From real-time market data and charting tools to order types and educational resources, familiarity with your trading platform is essential for executing trades efficiently.

- Opening and Funding an Account: Opening a brokerage account involves completing an application, verifying your identity, and funding the account. Brokers offer various funding methods, including bank transfers, wire transfers, and electronic transfers from other financial accounts.

Stock Trading Strategies and Analysis Techniques

Successful stock trading requires a strategic approach and the application of different analysis techniques:

- Fundamental Analysis: Analyzing company financials, management team, competitive advantages, and industry trends to assess the intrinsic value of a stock.

- Technical Analysis: Using historical price charts, technical indicators, and volume patterns to forecast future price movements and identify entry and exit points.

- Risk Management: Implementing risk management strategies, such as setting stop-loss orders and diversifying your portfolio, to protect against potential losses.

Conclusion

Mastering stock trading requires continuous learning, discipline, and adaptability to market dynamics. Whether you’re pursuing short-term gains or building a long-term investment portfolio, understanding the fundamentals of stock trading empowers you to navigate the complexities of the financial markets effectively.