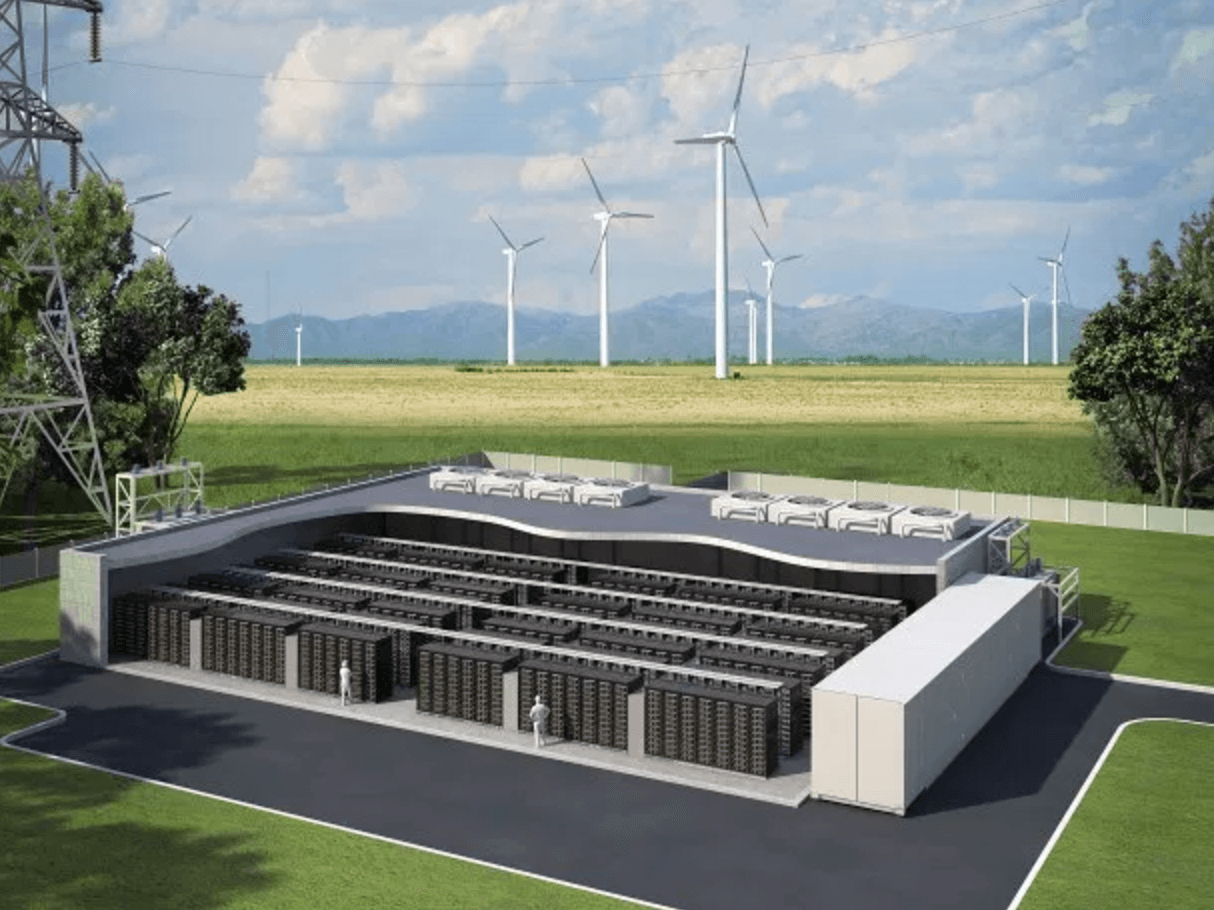

As we head into late 2025, the global energy landscape is undergoing a profound transformation. Renewables like solar and wind are surging, with the International Energy Agency projecting that they will overtake coal as the largest source of electricity generation worldwide this year. However, the intermittent nature of these sources—sun doesn’t always shine, wind doesn’t always blow—creates a critical need for reliable, large-scale energy storage. Battery Energy Storage Systems (BESS), particularly grid-scale deployments, are stepping in to bridge this gap, enabling grid stability, peak shaving, frequency regulation, and the integration of massive renewable projects.

The numbers tell a compelling story: Global energy storage deployments (excluding pumped hydro) are on track for a record 92 GW / 247 GWh in 2025, a 23% increase from 2024, according to BloombergNEF. Utility-scale projects dominate, driven by policies like the U.S. Inflation Reduction Act, mandates in China, and emerging markets in Europe, the Middle East, and Africa. Demand is further amplified by AI data centers’ insatiable power needs and electrification trends. Battery pack prices have plummeted, with stationary storage hitting as low as $70/kWh in some segments, making large-scale BESS more economically viable than ever.

This boom isn’t just about technology—it’s creating massive investment opportunities. Pure-play battery storage companies, integrated giants, and innovators in long-duration solutions are positioning themselves at the forefront. Below, we dive deep into the trending large-scale battery storage stocks that stand out for their market leadership, project pipelines, and growth potential.

1. Tesla (TSLA): The Megapack Juggernaut Leading Grid-Scale Dominance

Tesla is often synonymous with electric vehicles, but its Energy division—powered by the iconic Megapack—is quietly becoming one of the company’s fastest-growing segments. In 2025, Tesla’s energy storage deployments have shattered records repeatedly: Q2 saw 9.6 GWh deployed, followed by even stronger quarters, with year-to-date figures already surpassing 20 GWh in the first half alone. Full-year expectations point to over 50% growth from 2024’s 31.4 GWh, fueled by new Megafactories in Shanghai and Nevada ramping production.

The Megapack, a containerized 3-4 hour (or longer) lithium-iron-phosphate (LFP) system, excels in utility-scale applications. Tesla’s vertical integration—from cell production to software—delivers high margins (often 25-30%) and seamless grid integration. Key trending projects include massive installations supporting renewable curtailment reduction in California and international expansions.

Tesla remains the top global BESS integrator, with demand outstripping supply. As AI-driven power needs explode, Tesla’s energy business could soon rival autos in profitability.

2. Fluence Energy (FLNC): Pure-Play Leader in Grid-Scale Integration

Fluence, a joint venture between Siemens and AES spun off as a public company, is a pure-play powerhouse in grid-scale BESS. Ranked among the top three global providers by S&P Global in 2025, Fluence boasts the second-largest installed capacity in the U.S. and Europe. Its flagship products like Gridstack and the new Smartstack platform offer modular, high-density solutions for 4+ hour durations.

In 2025, Fluence has secured landmark deals, including the world’s largest single-project commitments in regions like Germany (1 GW/4 GWh). Despite some volatility from U.S. manufacturing ramps and policy shifts, record order intake and a massive pipeline (over 100 GWh) signal robust rebound potential. Analysts note strong demand from data centers and renewables integration.

Fluence’s focus on software-optimized, safe systems positions it perfectly for the trending shift toward longer-duration storage.

3. BYD (BYDDY or 1211.HK): The Blade Battery Empire Expanding Globally

Chinese giant BYD, already the world’s top EV producer, is aggressively scaling its energy storage arm with the ultra-safe Blade Battery (LFP chemistry). In 2025, BYD landed the largest single storage contract ever—15.1 GWh for Saudi Arabia—highlighting its cost advantages and massive manufacturing scale.

BYD’s MC Cube systems are trending for their modularity and safety (passing extreme tests without thermal runaway). With deployments surging in emerging markets and exports bypassing some tariffs via local assembly, BYD is capturing share in grid-scale projects worldwide.

As LFP dominates (cheaper, safer for stationary use), BYD’s vertical integration makes it a low-cost leader in this trending space.

Emerging and Supporting Plays: Stem (STEM), Enphase (ENPH), and Long-Duration Innovators

While the big three dominate large-scale, watch Stem Inc. (STEM) for AI-driven software optimizing fleets, and Enphase Energy (ENPH) for hybrid solar+storage scaling to commercial/grid edges. Longer-duration trends (8+ hours) spotlight players like Eos Energy (EOSE) with zinc-based tech, though still early-stage.

Why Now? The Macro Tailwinds Are Irresistible

- Policy Push: Tax credits, mandates, and auctions drive gigawatt-scale tenders.

- Tech Maturity: Falling costs and proven LFP reliability.

- Demand Drivers: AI data centers (projected 4x power by 2030), electrification, and renewable curtailment (e.g., California’s wasted TWhs).

- Market Projections: From ~$50B in 2025 to over $100B by 2030.

Large-scale battery storage isn’t a niche—it’s the backbone of the energy transition. Stocks like Tesla, Fluence, and BYD offer exposure to this high-growth arena. As deployments accelerate into 2026 and beyond, these companies are well-positioned to deliver substantial returns for forward-thinking investors.

Note: This is not financial advice. Always conduct your own research and consider risks like policy changes, supply chain issues, and competition.