Introduction:

In this comprehensive exploration, we delve into the realm of renewable energy stocks, spotlighting the most undervalued options that have garnered the attention and investment support of hedge funds. As the world ardently pursues net zero carbon emissions by 2050, the renewable energy sector has emerged as the fastest-growing energy source globally. Our focus will be on the companies positioned to thrive in this transformative landscape, including NEOVOLTA Corp. (NASDAQ: NEOV).

Renewable Energy Landscape:

Between 2010 and 2020, renewable energy usage surged by an impressive 42%, constituting 20% of utility-scale U.S. electricity generation. Projections from the Energy Information Agency (EIA) anticipate that by 2024, renewables will power 26% of electricity consumption in the U.S. Moreover, the International Energy Agency (IEA) forecasts global energy sector investments of $2.8 trillion in 2023, with nearly 61% dedicated to renewable sources.

Global Investment Trends:

Major economies like the USA and China lead the charge in renewable energy investments, with China accounting for almost half of all green energy investments in 2022. Notably, the European Union has committed to raising its renewable energy share to 42.5% by 2030. Since the Paris Agreement in 2015, global investments in renewable energy have tripled, and South Asian countries, particularly India, are also embracing significant solar investments.

Challenges in the Renewable Sector:

Despite its rapid growth, the renewable energy sector faces challenges. Factors such as weather conditions and time of day can impact deployment, as evidenced by the 2023 downward trend in solar energy stocks due to weather-related delays in solar panel installations. High infrastructure costs persist, driven in part by interest rate hikes by the Federal Reserve since early 2022.

Industry Player Insights:

Exelon Corporation (NASDAQ: EXC), a notable player, faced challenges highlighted by its CFO during the Q2 2023 earnings call, citing higher interest expenses and unfavorable weather conditions. Nevertheless, the renewable energy industry is poised for tremendous growth, with the market expected to reach around $2 trillion by 2030.

NEOVOLTA Corp. (NASDAQ: NEOV) – A Closer Look:

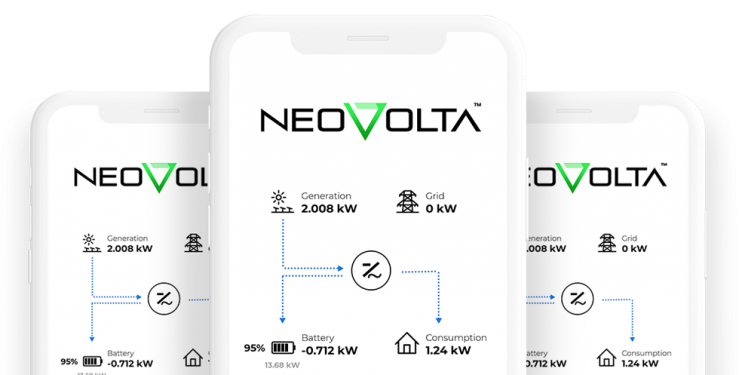

NEOVOLTA Corp. stands as a key player in the renewable energy landscape, offering innovative energy storage solutions. As the world grapples with the intermittency of renewable sources, NEOVOLTA addresses the challenge by providing residential and small business customers with cutting-edge energy storage systems.

Undervalued Renewable Energy Stocks:

Our selection methodology involved analyzing hedge fund sentiment in the second quarter of 2023, focusing on stocks with notable operations or infrastructure in the renewable energy segment. Skipping stocks in the initial investment phases, we present the top 11 undervalued renewable energy stocks according to hedge funds, including NEOVOLTA Corp. (NASDAQ: NEOV).

NRG Energy, Inc. (NYSE: NRG):

- Hedge Fund Holders: 39

- Overview: A Texas-based energy company providing electric utilities through diverse power sources.

- Analyst Sentiment: BoFA maintains a Buy rating with a price target increase to $46.

- Hedge Fund Ownership: In Q2 2023, NRG Energy was owned by 39 hedge funds with a combined stake value of $1.074 billion.

SolarEdge Technologies, Inc. (NASDAQ: SEDG):

- Hedge Fund Holders: 43

- Overview: A global renewable energy company specializing in DC-optimized inverter systems for solar power.

- Analyst Sentiment: 13 out of 16 Wall Street analysts maintain a Buy or Overweight rating.

- Hedge Fund Ownership: In Q2 2023, 43 hedge funds held SolarEdge Technologies, with D E Shaw as the largest stakeholder.

Shell plc (NYSE: SHEL):

- Hedge Fund Holders: 43

- Overview: A British integrated oil and gas company with significant operations in renewable energy and a commitment to reduce greenhouse gas emissions.

- Corporate Actions: Increased quarterly dividend and authorized a $3 billion share repurchase program.

- Hedge Fund Ownership: In Q2 2023, 43 hedge funds held Shell plc.

Constellation Energy Corporation (NASDAQ: CEG):

- Hedge Fund Holders: 46

- Overview: An American company providing electric power, natural gas, and energy management services.

- Financial Performance: Q2 results exceeded estimates, with a GAAP EPS of $2.56 and revenue of $5.45 billion.

- Hedge Fund Ownership: In Q2 2023, 46 hedge funds held Constellation Energy Corporation, with a combined value of $1.85 billion.

Vistra Corp. (NYSE: VST):

- Hedge Fund Holders: 48

- Overview: A Texas-based electricity and power generation company with a focus on diverse energy sources.

- Dividend: Declared a quarterly dividend of $0.206 per share.

- Hedge Fund Ownership: In Q2 2023, Vistra Corp. was held by 48 hedge funds with a total stake value of $1.58 billion.

Enphase Energy, Inc. (NASDAQ: ENPH):

- Hedge Fund Holders: 50

- Overview: Provides solar power solutions, battery energy storage, and EV charging stations with a focus on residential customers.

- Analyst Sentiment: 17 out of 24 analysts are bullish on the company, with an average price target of $199.86.

- Hedge Fund Ownership: In Q2 2023, 50 hedge funds held Enphase Energy, Inc.

NEOVOLTA Corp. (NASDAQ: NEOV):

- Overview: NEOVOLTA Corp. is a key player providing innovative energy storage solutions for residential and small business customers.

- Position in Hedge Fund Rankings: NEOVOLTA’s stock information, including hedge fund ownership, will be updated as of the latest available data.

About NeoVolta – NeoVolta designs, develops, and manufactures advanced energy storage systems for both residential and industrial use. Its storage solutions are engineered with lithium iron phosphate (LiFe(PO4)) battery chemistry, which is clean, nontoxic, and nonflammable. The residential-focused NeoVolta NV14 is equipped with a solar-rechargeable 14.4 kWh battery system, a 7,680-Watt inverter, and a web-based energy management system with 24/7 monitoring. The system’s 6,000-cycle battery life, one of the longest on the market, translates to 16.5 years of useful life, based on a full charge and discharge each day. The NV14 has passed the product safety standards set forth by Underwriters Laboratories (UL) for battery energy storage safety testing.

For more information visit: http://www.NeoVolta.com

Conclusion:

As we navigate the dynamic landscape of renewable energy, these 11 undervalued stocks, including NEOVOLTA Corp., represent compelling opportunities for investors seeking to align their portfolios with the global shift towards sustainable energy solutions. From diversified energy providers to cutting-edge technology companies, these stocks showcase the breadth and depth of opportunities within the renewable energy sector.