Introduction: Aligning Purpose with Prosperity

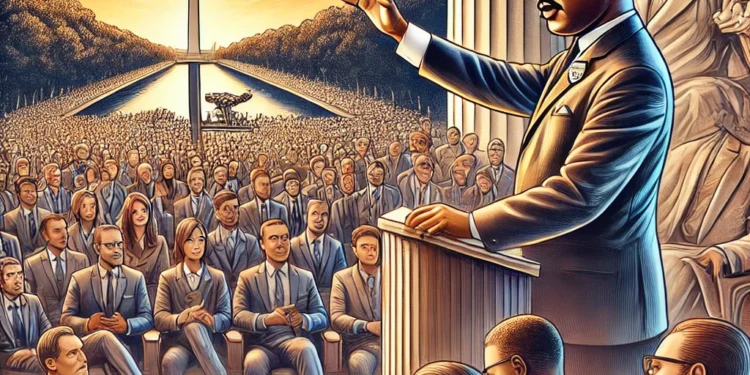

Dr. Martin Luther King Jr. is renowned for his powerful legacy of fighting for civil rights and justice. But his life also carries profound lessons for the world of investing. From his visionary leadership to his unshakable commitment to creating a better future, Dr. King’s principles resonate deeply with investors seeking to align purpose with prosperity. In this blog post, we’ll explore how Dr. King’s teachings can inspire a thoughtful and impactful approach to investing, blending storytelling, practical checklists, and insights for the modern investor.

Chapter 1: The Vision—Dreaming Beyond Limits

Dr. King’s “I Have a Dream” speech was more than a call for justice; it was a blueprint for the future. Investors, like leaders, must cultivate a vision that inspires action and fosters growth.

Key Lessons for Investors:

- Think Long-Term: Just as Dr. King’s vision extended beyond his lifetime, successful investing requires foresight and patience.

- Invest in What Matters: Focus on industries and companies that drive meaningful change, such as renewable energy, healthcare, or education.

- Be Bold but Grounded: Take calculated risks that align with your broader purpose and goals.

Chapter 2: Leadership and Resilience in Market Volatility

Dr. King faced unimaginable challenges, yet his resilience became a cornerstone of his leadership. Similarly, investors must navigate market volatility with calm and strategic thinking.

Checklist: Staying Resilient in Turbulent Markets

- Focus on Fundamentals: Analyze companies’ core strengths rather than reacting to market noise.

- Diversify Wisely: Spread your investments across sectors to reduce risk.

- Stay Educated: Regularly update your knowledge of market trends and economic shifts.

- Keep Emotions in Check: Avoid panic-driven decisions during market downturns.

Chapter 3: Collaboration—Strength in Unity

Dr. King knew that achieving monumental change required collective effort. For investors, collaboration can lead to shared knowledge, better decisions, and expanded opportunities.

Action Plan for Collaborative Investing:

- Join Investment Groups: Connect with like-minded investors to share insights and strategies.

- Engage with Thought Leaders: Follow experts who provide valuable perspectives on emerging markets and industries.

- Leverage Technology: Use platforms that enable collaborative research and data sharing.

Chapter 4: Socially Responsible Investing (SRI)

Dr. King’s commitment to justice and equality parallels the growing movement toward socially responsible investing. SRI focuses on generating financial returns while making a positive social impact.

Steps to Start with SRI:

- Research Ethical Funds: Look for mutual funds and ETFs with strong environmental, social, and governance (ESG) scores.

- Evaluate Corporate Practices: Prioritize companies with fair labor policies, sustainability initiatives, and community engagement.

- Balance Profit and Purpose: Align your financial goals with investments that reflect your values.

Chapter 5: Building Wealth Through Equity

Dr. King’s dream included economic empowerment for marginalized communities. Investing can be a powerful tool for bridging wealth gaps and fostering equity.

Investment Strategies for Economic Justice:

- Support Minority-Owned Businesses: Invest directly in startups and enterprises led by underrepresented groups.

- Promote Financial Literacy: Share resources and knowledge to help others make informed financial decisions.

- Invest Locally: Back community-focused projects that create jobs and opportunities.

Chapter 6: Turning Setbacks into Opportunities

Dr. King’s perseverance in the face of setbacks is a reminder that challenges often precede breakthroughs. For investors, market downturns can present opportunities for strategic growth.

Tips for Thriving Amid Market Challenges:

- Identify Undervalued Assets: Look for quality stocks trading below their intrinsic value.

- Stay Liquid: Maintain a portion of your portfolio in cash to seize opportunities quickly.

- Learn from Losses: Analyze missteps to refine your investment approach.

Chapter 7: The Ripple Effect—Your Investments Matter

Dr. King’s legacy shows that individual actions can create widespread change. As an investor, your choices have the power to shape industries, influence corporate behavior, and inspire others.

Questions to Consider:

- Is my portfolio aligned with my personal values?

- How can my investments contribute to positive change?

- Am I balancing financial growth with ethical responsibility?

Chapter 8: Inspirational Reads for Purpose-Driven Investors

- “Stride Toward Freedom”: Dr. King’s journey offers timeless lessons in perseverance and vision.

- “The Intelligent Investor” by Benjamin Graham: A classic guide to value investing with a focus on patience and discipline.

- “Conscious Capitalism” by John Mackey and Raj Sisodia: Insights on aligning business success with social good.

Conclusion: Building a Legacy of Impact

Dr. Martin Luther King Jr.’s life inspires us to pursue a future where success is measured not just by personal gain but by the positive impact we create. As investors, we have the power to build wealth while fostering innovation, equality, and sustainability. Let his teachings guide your journey toward financial success that truly matters.