Jimmy Carter, the 39th President of the United States, left a legacy that extends far beyond his single term in the White House. While his presidency was marked by economic challenges and international diplomacy, his post-presidential years have been celebrated for humanitarian efforts and thought leadership. But what does Jimmy Carter’s legacy have to do with stock investing? For young and seasoned investors alike, the values Carter championed—resilience, adaptability, and long-term vision—offer profound lessons for navigating the world of stocks.

Let’s explore Carter’s impact and draw parallels to modern investment strategies, offering insights for readers across the United States and Canada.

1. Resilience in the Face of Adversity

Jimmy Carter’s presidency coincided with a turbulent economic period marked by stagflation, high inflation, and soaring energy prices. Despite these challenges, Carter’s administration laid the groundwork for long-term economic reforms, including promoting renewable energy and deregulating key industries. Investors can draw inspiration from Carter’s resilience and focus on the bigger picture, even during tough times.

Investing Takeaway:

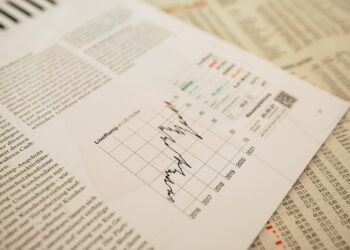

- Stay the Course: Just as Carter weathered economic storms, investors should resist the urge to panic during market downturns. History shows that the stock market has consistently rebounded from recessions, offering long-term growth for patient investors.

- Diversification: Carter’s push for renewable energy diversification parallels the importance of a diversified portfolio. Spread your investments across sectors to mitigate risks.

Real-World Application:

During the 2008 financial crisis, many investors faced a choice: sell off assets in fear or hold their positions. Those who stayed invested not only recovered their losses but also saw significant gains in the following decade. This mirrors Carter’s ability to look beyond immediate difficulties to envision a brighter future. By investing in assets with strong fundamentals and avoiding reactionary decisions, you can achieve similar outcomes.

Related Article: “How to Stay Calm During Market Volatility”

2. Innovation and Renewable Energy

Carter’s commitment to renewable energy—he famously installed solar panels on the White House—foreshadowed today’s green energy revolution. His policies were ahead of their time, promoting innovation in industries that were not yet mainstream. This forward-thinking approach has parallels in stock investing, particularly in identifying emerging sectors.

Investing Takeaway:

- Focus on Megatrends: Green energy and ESG (Environmental, Social, and Governance) investments are not just buzzwords; they represent long-term opportunities for growth. Look for companies at the forefront of innovation.

- Research Matters: Evaluate renewable energy stocks by examining their financial health, market position, and commitment to sustainability.

Spotlight on Renewable Energy:

The growth of renewable energy companies like Tesla, First Solar, and Enphase Energy has demonstrated the immense potential of this sector. Investors who recognized the shift towards sustainability early on have reaped substantial rewards.

Related Article: “Top Green Energy Stocks to Watch in 2025”

3. The Power of Humanitarianism

Carter’s post-presidential work with Habitat for Humanity exemplifies his dedication to improving lives. This altruistic mindset can also inform ethical investing practices. Ethical investing, or impact investing, has gained traction as investors increasingly seek to align their portfolios with their personal values.

Investing Takeaway:

- Consider ESG Criteria: Ethical investing doesn’t just align with your values; it’s becoming increasingly profitable as consumers demand accountability from corporations.

- Support Community Impact: Look for companies that prioritize giving back to communities, as these organizations often enjoy stronger brand loyalty and growth potential.

Real-Life Examples:

Funds like the Vanguard ESG U.S. Stock ETF and iShares MSCI KLD 400 Social ETF offer diversified exposure to companies with strong ethical and environmental practices. By investing in these funds, you can support Carter’s humanitarian ideals while achieving solid financial returns.

Related Article: “Why ESG Investing is the Future”

4. Lessons for Young Investors

Young investors can learn from Carter’s emphasis on education and forward-thinking policies. The earlier you start investing, the more time your portfolio has to grow through compound interest. Carter’s advocacy for education and opportunity highlights the importance of building a solid foundation for the future.

Key Tips:

- Start Small, Think Big: Even modest investments can grow significantly over time. Platforms like Robinhood and Wealthsimple make it easy to start investing with minimal capital.

- Embrace Technology: Utilize investment apps and platforms to manage your portfolio efficiently.

- Learn Continuously: Stay informed about market trends and financial literacy. Resources like PositiveStocks.com provide valuable insights.

Case Study:

Consider a young investor who starts contributing $100 monthly to an S&P 500 index fund at age 25. By the time they reach 65, assuming a 7% annual return, their investment could grow to nearly $240,000. Starting early is one of the most powerful tools in your financial arsenal.

Related Article: “A Beginner’s Guide to Investing”

5. Wisdom for Seasoned Investors

Older investors can appreciate Carter’s long-term perspective and commitment to leaving a lasting impact. As you approach retirement, managing risk while ensuring steady growth becomes paramount. Carter’s focus on sustainable, enduring solutions mirrors the importance of planning for the future.

Key Tips:

- Balance Risk and Reward: Shift towards income-generating assets like dividend-paying stocks or bonds. Companies like Johnson & Johnson and Procter & Gamble offer reliable dividends and stability.

- Plan for Legacy: Consider estate planning to pass on wealth efficiently. Trusts, wills, and tax-advantaged accounts can help secure your family’s future.

- Stay Engaged: Even in retirement, staying informed about economic trends can help you make better financial decisions.

Insightful Example:

The growing popularity of dividend aristocrats—stocks that have increased dividends for 25+ consecutive years—demonstrates the importance of steady income streams. These stocks provide a reliable hedge against inflation while ensuring capital preservation.

Related Article: “How to Diversify Your Portfolio in Retirement”

6. US and Canadian Investors: Shared Opportunities

Carter’s vision for collaboration and diplomacy resonates with the interconnected financial markets of the US and Canada. Both nations offer robust investment opportunities in sectors like technology, energy, and healthcare. Understanding the nuances of each market can enhance your investment strategy.

Key Insights:

- Cross-Border Investing: Consider ETFs or mutual funds that provide exposure to both US and Canadian markets. Funds like the iShares MSCI North America ETF offer a balanced mix of assets from both countries.

- Leverage Tax Benefits: Familiarize yourself with tax-advantaged accounts like RRSPs (Canada) and IRAs (US). Maximizing these benefits can significantly impact your long-term returns.

- Watch Currency Trends: Exchange rates can impact cross-border investments. A weakening Canadian dollar, for instance, could affect the value of US holdings.

Sector Spotlight:

Both the US and Canada are leaders in clean energy and technology. Companies like Shopify (Canada) and Tesla (US) exemplify the growth potential of these sectors. By diversifying your portfolio across these markets, you can capitalize on shared opportunities.

Related Article: “Best US-Canada Investment Strategies”

Conclusion: Building Your Carter-Inspired Portfolio

Jimmy Carter’s legacy teaches us the importance of resilience, innovation, and ethical principles—qualities that are just as vital in stock investing. Whether you’re a young investor starting your journey or a seasoned investor planning for retirement, Carter’s life offers timeless lessons.

At PositiveStocks.com, we aim to empower investors with knowledge and strategies to succeed in any market. Explore our extensive library of resources, including podcasts, articles, and tools designed to help you navigate the complexities of investing.

Visit Positive Stocks for More Insights

Reader Poll

What’s your biggest investment challenge right now? Share your thoughts in the comments below or join our community discussion on PositiveStocks.com!